Hilco Streambank is seeking offers to acquire certain intellectual property assets of Intu Shopping Centres Plc (In Administration) (“Intu” or the “Company”) on behalf of its Joint Administrators Jim Tucker, David Pike and Mike Pink, all of Interpath Ltd.

Hilco Streambank is seeking offers to acquire the “Intu” brand and related intellectual property assets.

This is a rare opportunity to acquire the iconic brand behind a former retail property giant.

Intu formerly owned, developed and managed many of the most popular shopping centres in some of the strongest footfall locations in the UK. As such, the Intu brand is synonymous with UK retail and leisure and is recognised by millions of consumers across the UK. The Intu’s Group’s retail property portfolio empire comprised 18 shopping centres across the UK (including nine of the UK’s top-20). The Intu Group directly employed over 2,000 people prior to Administration and generated revenue in excess of £600m at its peak.

Each with an attractive blend of top brands, a variety of trendy restaurants and a range of exciting leisure events, Intu shopping centres attracted c. 400 million shoppers per year resulting in a high level of brand awareness. Rising to the challenge of a shifting retail landscape, Intu also launched the UK’s first online shopping centre and a buyer can capitalise on established high-traffic domain names which form part of this acquisition opportunity.

The Intu brand benefits from a strong legacy and heritage. Founded by South African-British businessman Sir Donald Gordon in 1980 under the historic Transatlantic Insurance Holdings name, the business was initially an insurance and financial sector-focused investment holding company before evolving to largely focus on shopping centre management and development under the Intu brand name. The Intu portfolio formerly boasted some of the largest and most visited shopping centres in the UK such as the Metrocentre in Gateshead, North East England and the Trafford Centre in Manchester, North West England. As a result of a long history of strategic acquisitions and growth, Intu cemented its status as a retail and property giant.

Intu Brand

The Intu brand name has been in use since 2013 when Capital Shopping Centres Group (originally founded in 1980 as Liberty International) rebranded as Intu, positioned as a fresh consumer-facing brand.

Intu was the UK’s largest, and the only national, shopping centre brand with a presence in many major cities including London, Manchester, Newcastle, Cardiff and Glasgow.

With the adoption of its signature orange and black brand identity and bird logo, representing a “symbol of joy”, Intu’s colourful £25m national rebrand made Intu shopping centres a destination.

The core vision for Intu was to create places people loved to be, where visitors smile, brands succeed and communities thrive.

There is a strong awareness of the Intu brand in the UK and Europe. The brand is extremely well-known, being recognisable to millions of former customers.

Intu has attracted considerable media attention from outlets including the BBC, the Guardian and the Financial Times and has been bolstered by television advertising.

Trade Marks [1]

The Intu brand name and logos are protected by a portfolio of trade marks registered in the UK and internationally.

A full trade mark schedule is available to download here.

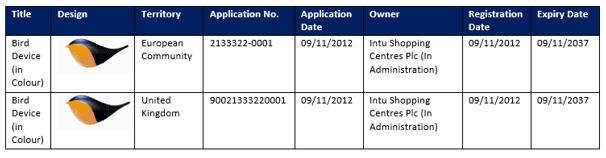

Designs

The Company owns registered designs protecting the recognisable bird logo associated with the Intu brand.

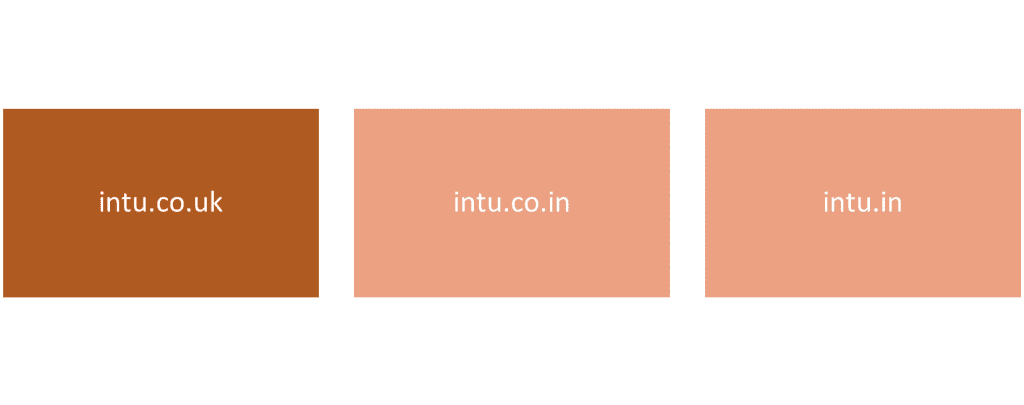

Domain Names

The Company has a portfolio of Intu-branded domain names, including the attractive, four-letter domain name intu.co.uk.

The high traffic intu.co.uk domain name was previously linked to an Intu e-commerce platform, directly driving revenue through commission earned on affiliate sales.

The domain names available to acquire are listed below.

Notes

[1] Please note Prozone Intu Developers Private Limited may have ongoing rights to use Intu marks in India.

All expressions of interest and offers should be directed to Hilco Streambank in writing. A Bid Submission Form for submitting offers is available on request.

The bidder acknowledges that Hilco acts as an agent for the Joint Administrators of the Company who offer for sale only what right, title and interest (if any) the Company possesses in the assets. Such sale will be without any warranties, expressed or implied. The information provided has not been verified by Hilco or the Joint Administrators and bidders are deemed to have carried out their own due diligence.

VAT, if applicable, at 20% will be added to the price. A non-refundable deposit of 20% will be payable by the buyer within 48 hours of bid acceptance. A buyer’s premium of 10% of the sale price is payable by the winning bidder. Legal completion to occur within 5 business days of bid acceptance. Hilco Streambank’s full Terms and Conditions apply.